Global Demand Surge: Why Glass Fragrance Bottles Are Outselling Plastic?

The global fragrance and aromatherapy market, valued at $23.74 billion in 2023, is undergoing a material transformation — and glass is winning. Driven by tightening environmental regulations, evolving consumer values, and the premiumization of home wellness, glass fragrance bottles are rapidly displacing plastic alternatives across Europe, North America, and Asia-Pacific markets. This shift isn’t merely a trend; it’s a structural realignment in packaging design, and Chinese manufacturers like Cupwind are at the epicenter of this change.

The Environmental Imperative

Plastic packaging, once dominant for its low cost and light weight, now faces mounting regulatory and reputational pressure. The European Union’s Single-Use Plastics Directive, alongside similar policies in the UK and Canada, is phasing out non-recyclable plastic components in consumer goods. Consumers, particularly in premium segments, are actively rejecting single-use plastics — 68% of global beauty buyers now prioritize sustainable packaging, according to industry surveys. Glass, in contrast, is infinitely recyclable without loss of quality, and its inert nature preserves the integrity of essential oils and fragrances far better than plastic, which can leach chemicals or degrade under UV exposure. This makes eco-friendly refillable diffuser bottles China not just a sourcing option, but a necessity for brands committed to long-term sustainability.

The Premiumization of Aromatherapy

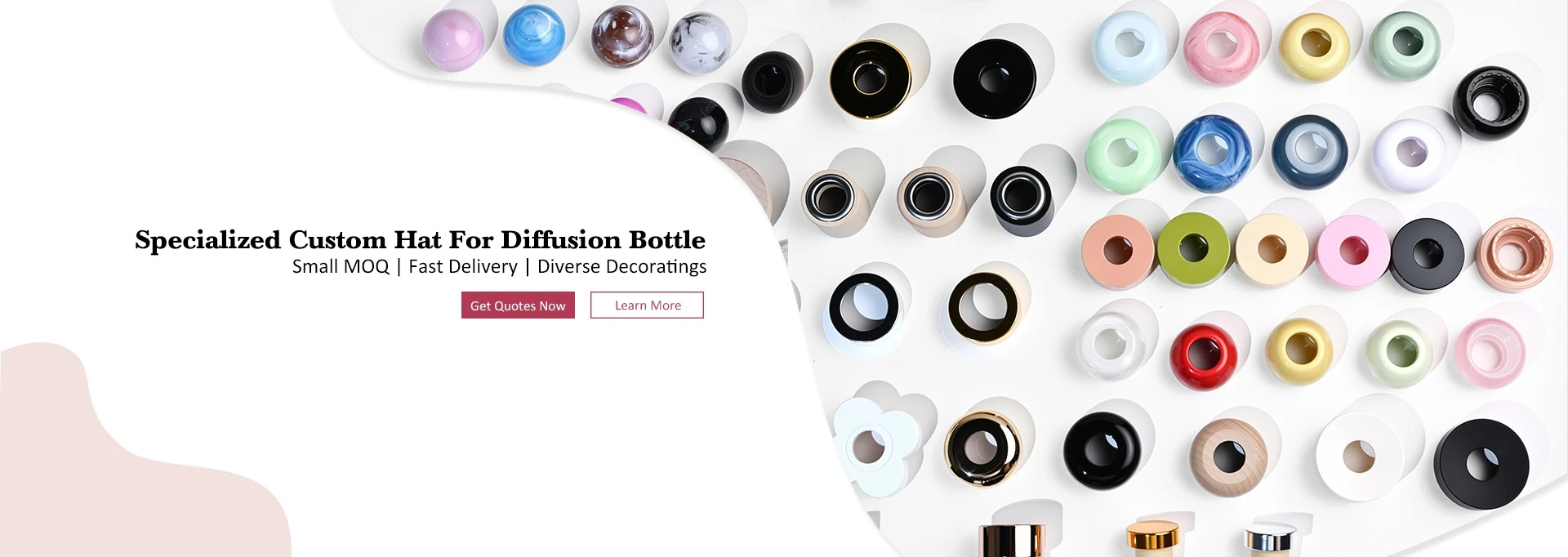

The aromatherapy and home fragrance sector is booming, projected to grow at a CAGR of over 7.6% through 2030. As consumers seek sensory luxury, the packaging itself becomes part of the experience. Glass conveys quality, transparency, and craftsmanship — attributes plastic cannot replicate. High-clarity glass vessels enhance visual appeal, while customizable finishes — from frosted textures to hand-painted accents — elevate brand perception. This demand has fueled a surge in orders for custom essential oil diffuser bottles caps, where precision-engineered caps with ceramic or bamboo finishes are no longer optional, but expected by luxury retailers and direct-to-consumer brands alike.

China’s Manufacturing Edge: Powering the Shift

The scalability of this transition is made possible by China’s unmatched manufacturing ecosystem. In Shenzhen and Guangdong, a dense network of specialized glassware suppliers offers unparalleled flexibility. Unlike Western producers burdened by high labor and compliance costs, Chinese factories like Cupwind deliver:

Low MOQ luxury diffuser vessels manufacturer capabilities — orders as small as 100–300 units with full customization, enabling niche brands to test markets without inventory risk.

Rapid prototyping and in-house decoration (engraving, electroplating, color spraying) reducing lead times by 40–60%.

End-to-end export readiness, from ISO-certified production to FOB shipping, ensuring seamless integration into global supply chains.

This combination of agility, quality control, and cost efficiency has positioned Cupwind as a trusted partner for brands seeking to align with the global shift toward sustainable, high-end packaging.

Glass as the New Standard

The data is clear: glass fragrance bottles are outselling plastic not because of nostalgia, but because they better serve modern consumer expectations — for purity, performance, and planetary responsibility. As brands compete on experience rather than just price, the choice is no longer between plastic and glass — it’s between obsolescence and evolution. For manufacturers and retailers alike, partnering with a Low MOQ luxury diffuser vessels manufacturer in China that specializes in eco-friendly refillable diffuser bottles China and delivers custom essential oil diffuser bottles caps isn’t a cost-saving tactic — it’s a strategic imperative for growth in the next decade.

Cupwind stands ready to help you lead that change.